Opening a Mizuho bank account in 2026 for foreigners

Mizuho Bank is one of the largest and most reputable banks in Japan, offering a wide range of financial services to both Japanese and foreign nationals.

If you are living or working in Japan, opening a Mizuho account will make it easy to manage your salary, pay bills, shop online, and even send money internationally. This article will provide detailed instructions on how to open a Mizuho bank account for foreigners in 2026.

1. Requirements for Opening a Mizuho Account for Foreigners

Before delving into the procedures, you need to ensure you meet the following basic requirements:

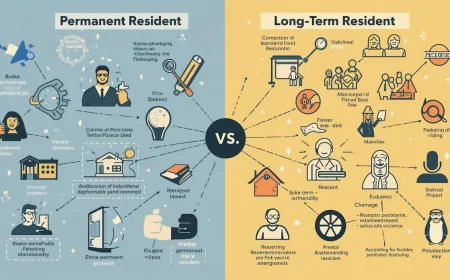

- Legal Status:

Foreigners wishing to open an account at Mizuho must have legal status in Japan, such as a work visa, student visa, permanent residency visa, or family visa. - Age:

You must be 15 years old or older to open an account. If under 20, you need the consent of a guardian. - Valid Identification Documents:

A Residence Card (在留カード) or My Number Card is required, along with a passport if requested by the bank. - Japanese Phone Number:

A local phone number will be needed to receive notifications and OTP codes when opening an online account or using the banking app.

2. Prepare Necessary Documents

Mizuho requires several documents to verify your identity and residential address. Common documents include:

- Residence Card – mandatory.

Passport – additional, especially if the Residence Card is incomplete.

Proof of address in Japan – usually a residence card showing your current address. In some cases, the bank may request utility bills (electricity, water, gas) or rental bills. - Japanese Mobile Phone Number – needed to register for internet banking or receive OTPs.

- Mizuho account opening invitation letter or application form – available at the counter or downloadable from the website.

Note: If this is your first time opening an account, the bank will require original documents, not copies.

3. Types of Mizuho Accounts

Before opening an account, you should know that Mizuho Bank offers several types of accounts:

- Personal Account 普通預金 (Futsuu Yokin)

Used for receiving salary, daily payments, and money transfers.

Usually comes with an ATM card. - Savings Account 定期預金 (Teiki Yokin)

For those who want to deposit money long-term and earn higher interest.

Terms range from 1 month to 5 years. - Foreign Currency Account 外貨預金 (Gaika Yokin)

For those who want to deposit savings in USD, EUR, or other foreign currencies.

Suitable if you frequently transfer money internationally.

For new foreigners, the Futsuu Yokin account is the most popular option.

4. How to open an account at a Mizuho branch

Opening an account directly at a branch is still the most common method, especially if you are unfamiliar with Japanese banks. Here are the steps:

- Step 1: Find a branch near you

Visit the Mizuho website: https://www.mizuhobank.co.jp

Select “支店検索” (Find a branch) to find a branch near where you live or work. - Remember the business hours: usually Monday–Friday, 9:00–15:00.

- Step 2: Prepare Documents

Bring:

Residence Card

Passport

Japanese Phone Number

A small amount of money for the initial deposit (approximately 1,000 yen)

Step 3: Fill Out the Application Form

At the counter, you will be given an account opening application form (口座開設申込書).

Fill in your personal information: name, date of birth, address, phone number, email. - If you don't speak Japanese, you can ask for assistance in English. Some branches have English-speaking staff.

- Step 4: Identity Verification

The bank staff will check your documents and take copies. - They may ask some questions to verify your identity: for example, your job, workplace, and purpose of opening the account.

- Step 5: Receive your ATM card

After your application is accepted, you will receive your Mizuho ATM card at the counter or it will be sent to your address within a few days.

The bank will also provide information about Internet Banking and the mobile app to manage your account.

5. Open a Mizuho account online

Mizuho also allows foreigners to open accounts online, but currently the procedure still requires one-time verification at the counter or sending documents by mail. The basic steps are as follows:

- Step 1: Access the online account opening website

Access: https://www.mizuhobank.co.jp/retail/accounts/opening/

Select 口座開設(インターネット受付) (Open an account online). - Step 2: Fill in Personal Information

Full name, date of birth, address, phone number, email.

Select account type: Futsuu Yokin (regular).

Provide information about your residence status and employment. - Step 3: Identity Verification

You may be required to upload images of your Residence Card and passport. - In some cases, the bank will send a PIN or require you to visit a branch to verify your documents.

- Step 4: Receive ATM Card

After your application is approved, your ATM card will be sent to your address.

You will also receive login information for Internet Banking and Mobile Banking.

6. Using Internet Banking and Mobile App

After opening an account, you can use:

- Mizuho Direct (Internet Banking)

Check balance, transfer money domestically and internationally, pay bills. - Log in using your customer ID and password or the OTP code sent to your phone.

- Mizuho Mobile App

Check balance, top up mobile phone credit, make quick money transfers.

Supports balance change notifications.

International money transfers

Mizuho supports SWIFT for sending and receiving money abroad.

Please note transaction fees and exchange rates.

7. Important Notes When Opening a Mizuho Account

- Language:

Most branches require Japanese, but some branches in Tokyo and Osaka offer English support. - If you are not proficient in Japanese, you should ask for an interpreter or choose a branch with English-speaking staff.

- Account Opening Time:

It usually takes from 30 minutes (at the counter) to 1 week (online + ATM card submission). - Minimum Balance:

There is no minimum balance requirement, but you should deposit at least 1,000 yen to activate your account. - ATM Card and Payments:

ATM cards can be used for cash withdrawals, transfers, and payments at stores that accept cards. - You can link your card to Apple Pay or Google Pay if you want to pay via your phone.

- Register for Internet Banking now:

This helps you manage your account, transfer money, pay bills, and avoid multiple visits to the counter. - Contact Information:

Remember the customer support phone number: 0120-3242-86 (Japanese/English).

8. Tips for Successfully Opening an Account for Foreigners

Prepare all necessary documents:

- Some branches will refuse if the documents are invalid.

Choose a large branch in a city:

Branchs in Tokyo, Osaka, and Yokohama have English-speaking staff and better support procedures for foreigners.

Bring your Japanese phone number and email address:

This helps with quick registration for Internet Banking and receiving OTPs. - Arrive during early business hours:

Avoid crowds and long waiting times. - If you have language difficulties:

You can use Mizuho Foreign Services or ask a friend or acquaintance to translate.

9. Comparison of Opening an Account at the Counter and Online

| Criteria | Opening at the Counter | Opening Online |

|---|---|---|

| Supported Languages | Japanese/English at major | Japanese branches (usually), with English email support |

| Completion Time | 30–60 minutes | 3–7 days (card delivery) |

| Document Verification | Right at the counter | Via photo or branch |

| Receiving ATM card | Right or within a few days | 3–7 days via mail |

| Suitable for beginners | Yes | Yes, if confident using the web |

For foreigners opening an account for the first time, going to the counter is still the simplest and most reliable way.

10. Conclusion

Opening a Mizuho bank account in Japan is not too difficult if you prepare all the necessary documents and choose a suitable branch. A Mizuho account helps you manage your finances, receive your salary, make daily payments, and conduct international transactions conveniently. You can choose to open directly at the counter or register online, but remember to verify your documents and receive your ATM card.

Some final tips:

- Prepare original and copies of your documents.

- Choose a branch with staff who assist foreigners.

- Use Internet Banking immediately for convenient management.

- Always remember the bank's contact information for assistance.

If you follow these steps correctly, opening a Mizuho account will be quick, simple, and convenient for your life in Japan in 2025.

Related Products