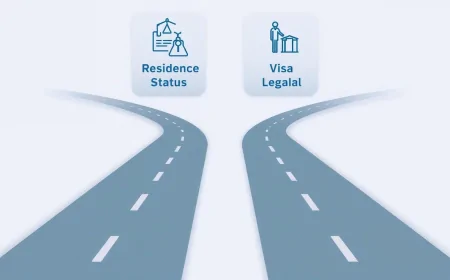

Financial sources and the process of getting a home/land loan in Japan

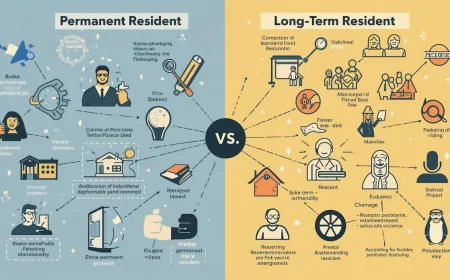

During the process of buying a house/land in Japan, foreigners may face many legal and financial challenges. Understanding the financial resources available and the home loan process is an important part of this process.

The following inJavi will provide detailed information on financial sources and the process of getting a home/land loan in Japan from a lawyer's perspective, in order to assist foreigners in their decision to buy real estate in this country. .

1. Financial resources available

- Borrow from a bank:

Banks are a popular source of financing for home/land purchases in Japan. Foreigners can consider borrowing from local banks or international banks with presence in Japan. However, the loan process from a bank requires several factors, including: credit assessment, solvency, proof of income and assets, as well as the provision of relevant documents and documents. - Borrowing from a credit institution:

Other credit institutions such as financial companies, insurance companies, and investment funds can also provide financing for the purchase of a house/land in Japan. This can have different financial requirements and processes, and is often governed by the laws and regulations of each organization.

2. The process of borrowing to buy a house/land

- Research and prepare:

Before starting the loan process, foreigners should research and understand the financial and legal requirements involved. This includes learning about interest rates, loan maximums, loan terms, security conditions, and required documentation to meet bank or credit union requirements. - Credit Appraisal:

After selecting the appropriate financial source, foreigners need to prepare the necessary documents for credit appraisal. This can include proof of identity, personal financial records, proof of income, property ownership and existing real estate. - Signing loan contract:

After the loan application is accepted, the foreigner will sign a loan contract with a bank or credit institution. This contract will stipulate loan conditions, interest rates, loans and repayment period. Borrowers need to carefully read and understand the content of the contract before signing. - Debt performance and repayment:

After the loan is approved, the foreigner will receive the loan amount to buy a house/land. During the repayment process, the borrower must comply with the conditions and repayment schedule specified in the loan contract.

Before deciding to buy a house/land in Japan, foreigners need to have a clear understanding of the financial resources available and the home/land loan process. Capturing relevant legal and financial information is crucial to ensure a legitimate and profitable home/land purchase decision. Attorneys and financial professionals can provide precise advice and assistance in this process.

記事に関連する商品