Taxes in Japan for foreigners

Foreigners who work and earn income in Japan are subject to the same tax laws as Japanese citizens.

This means that foreign workers are required to pay income tax on their earnings, and their employers are responsible for withholding the appropriate amount from their salaries and paying it to the government on their behalf.

In addition to income tax, foreign workers in Japan may also be required to pay social insurance premiums, which include health insurance, pension, and unemployment insurance. The amount of social insurance premiums that a foreign worker is required to pay depends on their income and employment status.

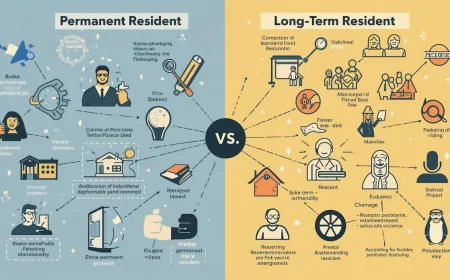

Foreign workers who are in Japan for less than a year are generally considered non-residents for tax purposes, and their income from Japanese sources is subject to a flat rate of 20% income tax. However, if they earn income from overseas, they may be subject to additional taxes in their home country.

Foreign workers who stay in Japan for more than a year are considered residents for tax purposes, and their income is subject to the same progressive income tax rates as Japanese citizens. However, they may be eligible for certain tax deductions and exemptions, depending on their circumstances.

It is important for foreign workers in Japan to be aware of their tax obligations and to file their taxes accurately and on time. Failing to pay taxes or filing inaccurate tax returns can result in fines, penalties, and even deportation in some cases.

記事に関連する商品