Pensions in Japan

Japan's pension system is designed to provide financial stability and healthcare support for retirees, including foreign residents. By understanding the structure and benefits of the system, foreigners can better prepare for a secure and comfortable retirement in Japan.

Japan offers a comprehensive pension system designed to provide financial security for retirees. For foreigners living in Japan or considering retirement in this beautiful country, understanding how the pension system works is crucial. This guide will explain the key aspects of pensions in Japan and provide essential information for expatriates.

Overview of the Japanese Pension System

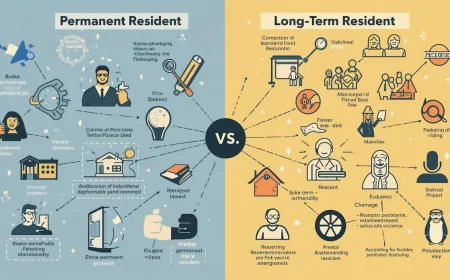

The Japanese pension system consists of two main components:

- National Pension (Kokumin Nenkin): This basic pension is mandatory for all residents of Japan aged 20 to 59, including foreign residents. Contributions are made monthly, and the benefits are paid starting at age 65.

- Employees' Pension Insurance (Kosei Nenkin): This system covers salaried workers and is managed by employers. Both employees and employers make contributions, resulting in higher benefits compared to the National Pension.

Key Features of the Pension System

Mandatory Enrollment: All residents, including foreigners, must enroll in the National Pension.

- Contribution Period: A minimum of 10 years of contributions is required to qualify for pension benefits.

- Flexible Pension Age: You can start receiving your pension benefits between the ages of 60 and 70. The benefit amount is adjusted based on the age you choose to start receiving it.

- Pension Calculation: The pension amount depends on the number of years of contribution and your average monthly income during the contribution period.

- Survivor Benefits: The system provides benefits to the surviving family members of a deceased pensioner.

Special Provisions for Foreigners

- Totalization Agreements: Japan has agreements with several countries (such as the United States, Germany, and Australia) to avoid double payment of pensions and to ensure that periods of contribution in different countries are considered for pension eligibility.

- Lump-Sum Withdrawal: Foreigners who leave Japan permanently can apply for a lump-sum withdrawal payment, provided they have contributed to the pension system for at least six months.

Additional Pension Options

- Corporate Pension Plans: Many companies in Japan offer their own pension plans as part of employee benefits, which provide additional financial security.

- Individual Pension Plans: These voluntary pension schemes allow individuals to contribute independently to supplement their retirement income.

Healthcare for Retirees

Japan's healthcare system is comprehensive and provides excellent coverage for retirees. Upon retirement, individuals can switch from employer-based health insurance to the National Health Insurance (Kokumin Kenko Hoken), ensuring continued access to medical care.

How to Apply for a Pension

- Register: Ensure you are registered with the National Pension system.

- Contribute: Make regular contributions during your working years.

- Apply: When you reach retirement age, apply for your pension benefits through the Japan Pension Service.

Japan's pension system is designed to provide financial stability and healthcare support for retirees, including foreign residents. By understanding the structure and benefits of the system, foreigners can better prepare for a secure and comfortable retirement in Japan.

記事に関連する商品