Insurance in Japan

This article provides necessary information about different types of insurance in Japan, helping you understand the system and make a wise decision for your financial security and peace of mind.

Navigating the insurance system in Japan is essential for anyone planning to live or stay in the country for an extended period. Whether it's health, car, or home insurance, having the right coverage can provide peace of mind and financial protection. Here’s a comprehensive guide to understanding insurance in Japan.

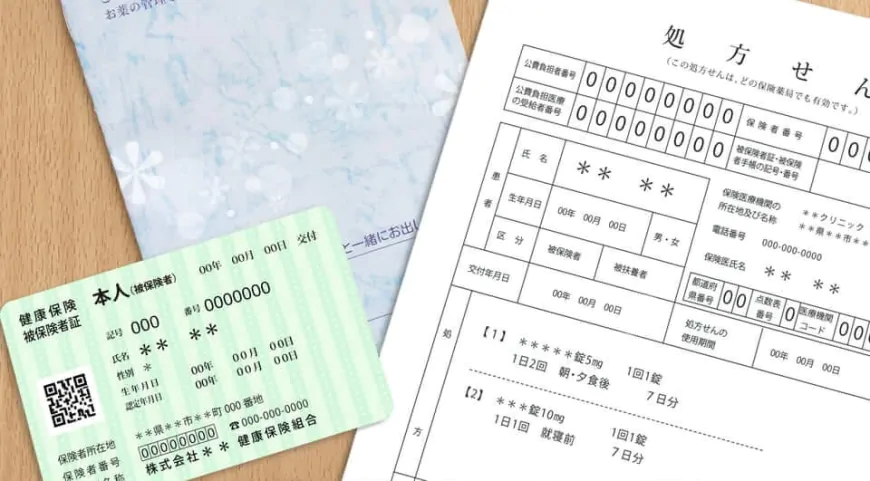

Health Insurance in Japan

Japan offers two main types of health insurance:

- Employee Health Insurance (Shakai Hoken): If you work full-time for a Japanese company, you will likely be enrolled in Shakai Hoken. This insurance covers a significant portion of medical expenses, including hospitalization, outpatient care, and some dental procedures. Premiums are typically shared between you and your employer.

- National Health Insurance (Kokumin Kenko Hoken): If you are self-employed, a student, or working part-time, you will need to enroll in National Health Insurance. Premiums are based on your income and are paid monthly. This insurance also covers a wide range of medical services, and you can apply at your local city or ward office.

Types of Insurance in Japan

- Home Insurance (Katei Hoken):

Protects your home and personal belongings from damage caused by natural disasters, fire, theft, and other risks. If you are renting, your landlord may require you to have renters' insurance. - Life Insurance (Seimei Hoken):

Provides financial support to your beneficiaries in the event of your death. Life insurance policies can also include coverage for critical illnesses and disabilities. - Travel Insurance:

Covers medical emergencies, trip cancellations, lost luggage, and other travel-related issues. It's essential for both short-term visitors and long-term residents who travel frequently. - Car Insurance:

Mandatory Liability Insurance (Jibaiseki Hoken): Required by law, this insurance covers damages to other people in case of an accident but has limited coverage.

Voluntary Car Insurance (Nini Hoken): Provides additional coverage, including damages to your vehicle, third-party property, and personal injury protection. It’s highly recommended to have this supplementary insurance.

How to Obtain Insurance

- Through Your Employer: If you work for a company, your employer will typically handle the enrollment process for employee health insurance.

- Local City or Ward Office: For National Health Insurance, you need to apply at your local city or ward office. Bring your residence card, passport, and proof of address.

- Insurance Companies: For car, home, life, and travel insurance, you can contact insurance companies directly. Many companies offer online applications, and some provide English-speaking services.

Insurance Premiums

- Health Insurance Premiums: Based on your income and calculated annually. Payments can be made monthly or quarterly.

- Car Insurance Premiums: Determined by factors such as your age, driving history, and the type of vehicle. Discounts may be available for safe drivers.

- Home and Life Insurance Premiums: Based on the coverage amount, type of policy, and your personal risk factors.

Claims Process

- Health Insurance: Present your health insurance card at the medical facility. You will only need to pay a portion of the total cost (typically 30%).

- Car Insurance: Report accidents to your insurance company immediately. They will guide you through the claim process and help with repairs or compensation.

- Home Insurance: Contact your insurer as soon as possible after damage occurs. Provide necessary documentation and evidence for your claim.

- Life Insurance: Beneficiaries should contact the insurance company to file a claim, providing required documents such as the death certificate.

Understanding and obtaining the right insurance in Japan is crucial for protecting yourself and your assets. Whether it’s health, car, home, or life insurance, being informed will help you make the best decisions for your situation. Ensure you have the necessary coverage to enjoy a secure and worry-free life in Japan.

記事に関連する商品