Instructions for Registering Insurance for Residents in Japan

One of the great benefits of becoming a resident in a foreign country is the assurance of healthcare coverage, similar to that of a local citizen.

When you step into a hospital in Japan, being able to communicate in Japanese can be extremely helpful, as many healthcare professionals here have limited English proficiency.

Moreover, foreign residents in Japan may be surprised by the costs associated with medical care, particularly when it comes to the bills for prescribed medications. Hence, it's essential to explore various insurance options to safeguard yourself in case of unexpected accidents or illnesses.

1. How to Register for Health Insurance in Japan

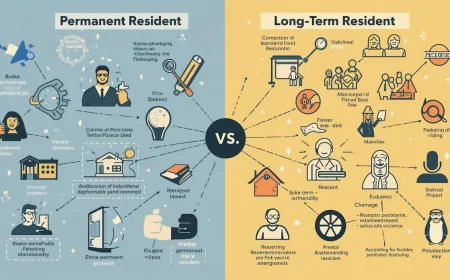

In Japan, there are two primary types of health insurance: for citizens and for foreign residents with long-term visa status. Both of these categories fall under the regulations of Employees' Health Insurance (kenko koken) and National Health Insurance (kokumin kenko hoken).

2. Employees' Health Insurance (Kenko Koken 健康保険)

This type of health insurance is for employees, and it is provided at your workplace. Your employer is responsible for paying half of the premiums for your Employees' Health Insurance (EHI), and the other half is deducted from your monthly salary.

EHI covers up to 70% of your medical bills, including those of your family members. The insurance premiums are calculated based on your income. For example, if you are a 30-year-old single individual earning an average income in Tokyo, you might pay around 15,000 JPY per month, while your employer covers the rest.

3. National Health Insurance (Kokumin Kenko Hoken 国民健康保険)

National Health Insurance (NHI) is for individuals under the age of 75, the unemployed, self-employed individuals (including subcontractors), retirees, and their family members who fall under these categories.

Similar to EHI, NHI covers up to 70% of medical expenses at hospitals. It's important to note that if you're under the age of 75, unemployed, self-employed, a retiree, or part of a family in these categories, you are eligible for NHI.

4. Longevity Medical Care System (Choju Iryo Seido 長寿医療制度)

This is for individuals aged 75 or above and for those aged 65 and over with certain disabilities. The local government administers the healthcare system for the elderly. The insurance premiums depend on the individual's income, and those with low incomes can receive higher coverage, up to 90% of medical expenses, which is more generous than other insurance options.

5. Private Health Insurance

Foreign tourists and short-term residents in Japan, typically staying for a month or more, are not eligible for EHI or NHI. However, they can still apply for private health insurance, which is the only option for short-term residents.

6. Summing Up the Costs

Health insurance is a mandatory requirement in Japan, and it offers a straightforward way to manage healthcare costs. In practice, almost all medical expenses, including surgeries, prescription medication, and even vaccinations, are covered under either Employees' Health Insurance or National Health Insurance. If you're arriving in Japan on a long-term visa, you have no choice but to comply with the insurance options regulated by the law.

Failing to acquire appropriate coverage may result in severe financial penalties, including retroactive payment of insurance premiums based on your arrival date in Japan. Therefore, it is crucial to ensure that you have the necessary health insurance in place to protect yourself while residing in Japan.

-------------------

Injavi.com - Visit Japan | Visit in Japan

Guide to living, studying and working in Japan

記事に関連する商品